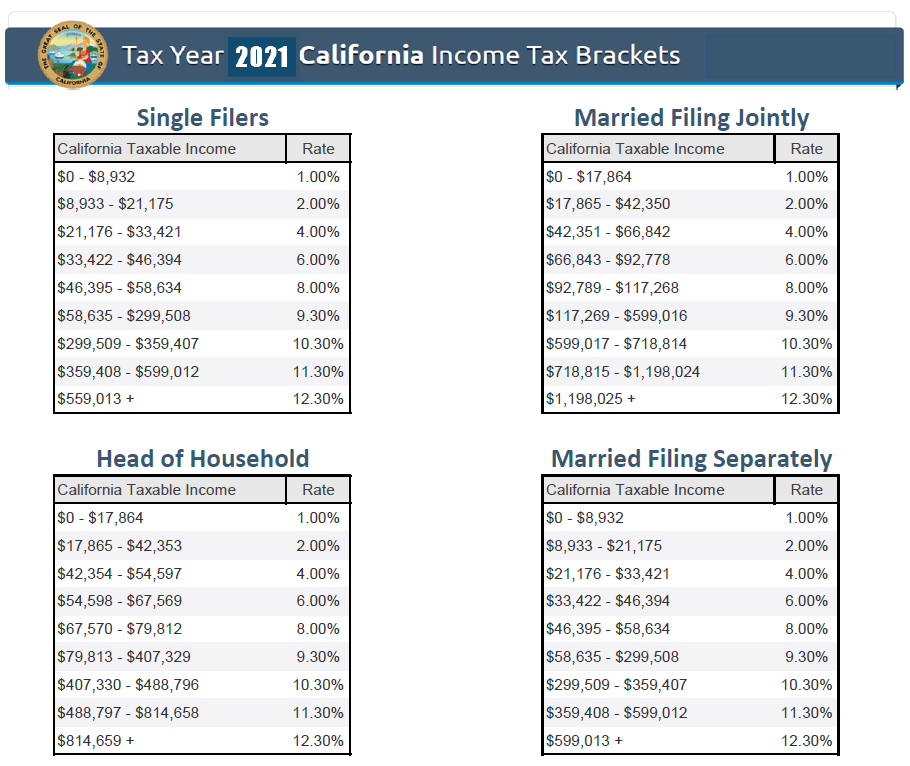

Tax Brackets 2021 California And Federal . Here are the rates and brackets for. Compare the standard deduction, alternative minimum tax,. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. california has nine tax brackets: enter your filing status and income to calculate your 2023 tax using the online calculator. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. find out your top 2021 california and federal taxes rates based on your income level and filing status. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. Find tax tables and rate schedules for prior years.

from federal-withholding-tables.net

The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. Compare the standard deduction, alternative minimum tax,. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. find out your top 2021 california and federal taxes rates based on your income level and filing status. Here are the rates and brackets for. Find tax tables and rate schedules for prior years. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. enter your filing status and income to calculate your 2023 tax using the online calculator. california has nine tax brackets:

California Tax Rates 2021 Table Federal Withholding Tables 2021

Tax Brackets 2021 California And Federal learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. Find tax tables and rate schedules for prior years. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. california has nine tax brackets: The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. enter your filing status and income to calculate your 2023 tax using the online calculator. find out your top 2021 california and federal taxes rates based on your income level and filing status. Here are the rates and brackets for. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. Compare the standard deduction, alternative minimum tax,.

From federalwithholdingtables.net

2021 Federal Tax Brackets Printable Federal Withholding Tables 2021 Tax Brackets 2021 California And Federal find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. Find tax tables and rate schedules for prior years. california has nine tax brackets: enter your filing status and income to calculate your 2023 tax using the online calculator. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%,. Tax Brackets 2021 California And Federal.

From proconnect.intuit.com

2021 Tax Rates Quick Reference Guide Tax Brackets, Tax Tables & More Tax Brackets 2021 California And Federal california has nine tax brackets: Here are the rates and brackets for. enter your filing status and income to calculate your 2023 tax using the online calculator. Find tax tables and rate schedules for prior years. Compare the standard deduction, alternative minimum tax,. find out your top 2021 california and federal taxes rates based on your income. Tax Brackets 2021 California And Federal.

From www.blog.rapidtax.com

California Tax RapidTax Tax Brackets 2021 California And Federal learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. find out your top 2021 california and federal taxes rates based on your income level and filing status. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. california. Tax Brackets 2021 California And Federal.

From innovationolfe.weebly.com

California state tax brackets 2021 innovationOlfe Tax Brackets 2021 California And Federal find out your top 2021 california and federal taxes rates based on your income level and filing status. Find tax tables and rate schedules for prior years. enter your filing status and income to calculate your 2023 tax using the online calculator. california has nine tax brackets: 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%.. Tax Brackets 2021 California And Federal.

From www.pdffiller.com

2021 Form CA FTB Tax Table Fill Online, Printable, Fillable, Blank pdfFiller Tax Brackets 2021 California And Federal 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. find out your top 2021 california and federal taxes rates based on your income level and filing status. Here are the rates and brackets for. enter your filing status and. Tax Brackets 2021 California And Federal.

From golfprep.weebly.com

Irs new tax bracket 2021 golfprep Tax Brackets 2021 California And Federal california has nine tax brackets: learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. find out your top 2021 california and federal taxes rates based on your income level and filing status. Compare the standard deduction, alternative minimum tax,. find out how to file and pay your 2021 california. Tax Brackets 2021 California And Federal.

From federalwithholdingtables.net

2021 IRS Tax Brackets Federal Withholding Tables 2021 Tax Brackets 2021 California And Federal find out your top 2021 california and federal taxes rates based on your income level and filing status. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. enter your filing status and income to calculate your 2023 tax using the online calculator. learn about. Tax Brackets 2021 California And Federal.

From federalwithholdingtables.net

IRS Tax Chart 2021 Federal Withholding Tables 2021 Tax Brackets 2021 California And Federal enter your filing status and income to calculate your 2023 tax using the online calculator. Compare the standard deduction, alternative minimum tax,. california has nine tax brackets: learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. Find tax tables and rate schedules for prior years. Here are the rates and. Tax Brackets 2021 California And Federal.

From tewsmag.weebly.com

Federal tax brackets 2021 tewsmag Tax Brackets 2021 California And Federal Here are the rates and brackets for. enter your filing status and income to calculate your 2023 tax using the online calculator. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. california has nine tax brackets: Compare the standard deduction, alternative minimum tax,. find out your top 2021 california and federal taxes rates based on your. Tax Brackets 2021 California And Federal.

From federalwithholdingtables.net

2021 IRS Tax Brackets Table Federal Withholding Tables 2021 Tax Brackets 2021 California And Federal 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. Find tax tables and rate schedules for prior years. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. . Tax Brackets 2021 California And Federal.

From www.ledgerladies.com

Tax Brackets — Ledger Ladies Tax Brackets 2021 California And Federal learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. enter your filing status and income to calculate your 2023 tax using the online calculator. Find tax tables and rate schedules for prior years. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021.. Tax Brackets 2021 California And Federal.

From goneonfire.com

2020 & 2021 Federal Tax Brackets A Side by Side Comparison Gone on FIRE Tax Brackets 2021 California And Federal enter your filing status and income to calculate your 2023 tax using the online calculator. Here are the rates and brackets for. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. Compare the standard deduction, alternative minimum tax,. The tax tables. Tax Brackets 2021 California And Federal.

From lokife.weebly.com

2021 tax brackets married filing jointly lokife Tax Brackets 2021 California And Federal find out your top 2021 california and federal taxes rates based on your income level and filing status. Compare the standard deduction, alternative minimum tax,. enter your filing status and income to calculate your 2023 tax using the online calculator. california has nine tax brackets: Find tax tables and rate schedules for prior years. learn about. Tax Brackets 2021 California And Federal.

From www.ntu.org

Tax Brackets for 2021 and 2022 Publications National Taxpayers Union Tax Brackets 2021 California And Federal Here are the rates and brackets for. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. california has nine tax brackets: Compare the standard deduction, alternative minimum tax,. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. find out your top. Tax Brackets 2021 California And Federal.

From genevrawtess.pages.dev

2024 California Tax Brackets Table Ronni Raeann Tax Brackets 2021 California And Federal The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2021. find out your top 2021 california and federal taxes rates based on your income level and filing status. Compare the standard deduction, alternative minimum tax,. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. find out how to file. Tax Brackets 2021 California And Federal.

From klopwatch.weebly.com

Federal tax brackets 2021 vs 2022 klopwatch Tax Brackets 2021 California And Federal california has nine tax brackets: 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. Find tax tables and rate schedules for prior years. Here are the rates and brackets for. The tax tables below include the tax rates, thresholds and allowances. Tax Brackets 2021 California And Federal.

From federal-withholding-tables.net

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021 Tax Brackets 2021 California And Federal enter your filing status and income to calculate your 2023 tax using the online calculator. Here are the rates and brackets for. Find tax tables and rate schedules for prior years. Compare the standard deduction, alternative minimum tax,. learn about the personal income tax brackets, exemption credits, itemized deductions, and miscellaneous credits for california. The tax tables below. Tax Brackets 2021 California And Federal.

From federal-withholding-tables.net

The WageBracket Method And Standard Withholding For Federal Taxes 2021 Federal Tax Brackets 2021 California And Federal Find tax tables and rate schedules for prior years. Here are the rates and brackets for. find out your top 2021 california and federal taxes rates based on your income level and filing status. find out how to file and pay your 2021 california personal income tax return, claim credits and deductions, and avoid common. learn about. Tax Brackets 2021 California And Federal.